Most countries have a main property website or two that covers the whole country.

The US also has a couple of major sites which appear to cover the all states (www.realtor.com being the one I have used).

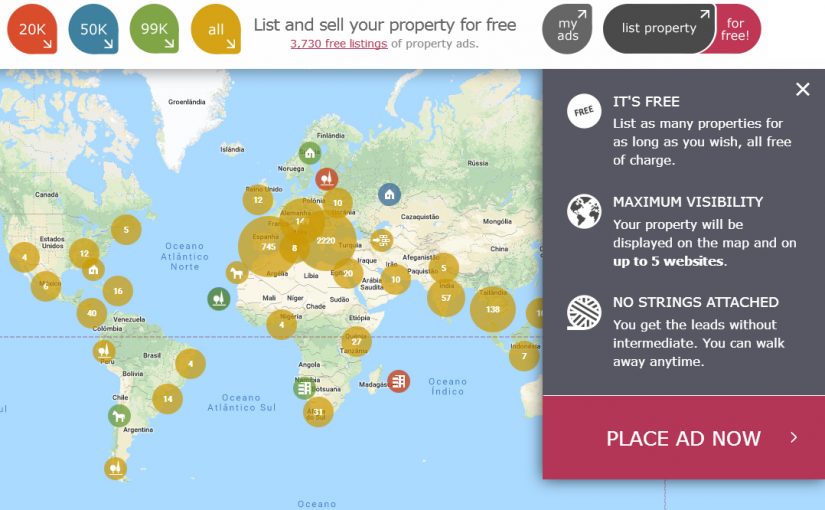

One thing that seems to be missing in Europe is a joined up property website.

One that summaries all properties for sale throughout the whole European area.

Continue reading The lack of a single European Property Website